2020 Company Tax Rate Malaysia

On the First 70000 Next 30000. 13 rows Malaysia Residents Income Tax Tables in 2020.

Car Insurance Tax Deductible Malaysia 2021 Tax Deductions Car Insurance Getting Car Insurance

Income Tax Rates and Thresholds.

. Full capital allowance can be claimed in the year of acquisition assuming the asset has been put into use. THE IMPACT ON THE MAN IN THE STREET 1. 100 capital allowance on small value assets.

On the First 20000 Next 15000. 25-Mar-20 For taxable income over But not over Tax rate is 0 21 Corporate Tax Rate Schedule 2019. This publication is a quick reference guide outlining Malaysian tax information which is based on taxation laws and current practices.

YA 2020 and Onwards Resident company with paid-up capital of RM25 million and below at the beginning of the basis period SME Note 1. Corporation Income Tax Return. - No maximum limit of RM20000 per year.

Malaysia Personal Income Tax Rate A graduated scale of rates of tax is applied to chargeable income of resident individual taxpayers starting from 0 on the first RM5000 to a maximum of 30 on chargeable income exceeding RM2000000 with effect from YA 2020. Based on this amount the income tax to pay the government is RM1640 at a rate of 8. Personal Tax 2021 Calculation.

Running your business as a separate legal entity through a private limited company provides you with benefits such as personal financial security and access to funding but it also requires compliance with. However if you claimed RM13500 in tax deductions and tax reliefs your chargeable income would reduce to. Understanding the tax obligations of companies in Malaysia makes tax compliance a smoother process.

And Unlimited special capital allowance claim of 100 on assets valued at RM2000 or less per asset ie. Thats a difference of RM1055 in taxes. On the First 5000 Next 15000.

Following the Budget 2020 announcement in October 2019 the reduced rate of 17 is applicable to the first RM600000 chargeable income in hopes that more Malaysians will get. What is Corporate Tax Rate in Malaysia. Prior to YA 2020.

Corporate Tax Rate in Malaysia remained unchanged at 24 in 2021. And Company having gross business income from one or more sources for the relevant year of assessment of not more than RM50 million On first RM600000 chargeable income 17 On subsequent chargeable income 24. 2019 Instructions for Form 1120.

On the First 50000 Next 20000. That does not control directly or indirectly another company that has paid-up capital of more than MYR. On first RM600000 of chargeable income.

On the first 5000 next 15000. On the First 5000. Resident companies are taxed at the rate of 24 while those with paid-up capital of RM25 million or less and gross business income of not more than RM50 million are taxed at the following scale rates.

Income tax scale rates The income tax scale rates remain at 0 to 28 for the first RM2 million in chargeable income. Not only has the corporate tax rate been decreased over the years the government has also given SMEs a special rate of 17 on the first RM500000 chargeable income for YA 2019. Check out the company tax rates of 2021.

This booklet also incorporates in coloured italics the 2022 Malaysian Budget proposals based on the Budget 2022 announcement on 29 October 2021 and the Finance Bill 2021These proposals will not become law until their enactment and may be. If You Want To Do. Income Taxes in Malaysia For Non-Residents.

Chargeable income of up to rm100 million will continue to be taxed at 24. Total tax amount RM150. Lower income tax rate.

Corporate Tax Rate Schedule 2020 Source. Chargeable income less than RM35000 can get a RM 400 tax rebate so Ali does not need to pay any tax amount to LHDN. Limit of up to RM13000 is not applicable only for companies limit of up to RM20000 is not applicable only for companies.

With paid-up capital of 25 million Malaysian ringgit MYR or less and gross income from business of not more than MYR 50 million. Chargeable income RM20000. Data published Yearly by Inland Revenue Board.

- 17 on the first RM600000 of chargeable income. A SME company limited liabilities partnership LLP is eligible to enjoy. However companies or LLPs with paid-up ordinary share capital of MYR25 million or less and gross income of not more than MYR50 million will be subject to a two-tier tax rate of 17 and 24.

Total tax reliefs RM16000. Income remitted to malaysia will be taxed at the rate of 3 on gross income. Malaysia corporate tax rate 1997 2021 data 2022 2023 forecast historical chart.

Companies and LLPs are generally subject to a corporate tax rate of 24. - Assets costs not exceeding RM200000. Corporate Tax Rate in Malaysia remained unchanged at 24 percent in 2021 from 24 percent in 2020.

Ali work under real estate company with RM3000 monthly salary. Resident company other than company described below 24. On the first RM500000 of chargeable income.

CIT rate for year of assessment 20202021. This would enable you to drop down a tax bracket lower your tax rate to 3 and reduce the amount of taxes you are required to pay from RM1640 to RM585. Non-resident individuals pay tax at a flat rate of 30 with effect from YA 2020.

For example lets say your annual taxable income is RM48000. The maximum rate was 30 and minimum was 24. How does Budget 2020 impact the rakyat.

These companies are taxed at a rate of 24 Annually. This rate is relatively lower than what we have seen in the previous year. Tax rate of 17.

Inland Revenue Board of Malaysia Corporate Tax Rate in Malaysia averaged 2612 percent from 1997 until 2021 reaching an all time high of 30 percent in 1997 and a record low of 24 percent in 2015. Small and medium enterprises SMEs pay slightly different company tax as compared to other resident companies. Lets start from the perspective of the rakyat then zoom out to how it affects business in particular Visit Malaysia Year 2020 and the economy at large.

Annual income RM36000. Preferential tax rate where the corporate income tax rate on the first RM600000 of chargeable income of an SME 1 is taxed at 17 with the balance taxed at 24. Limit on claiming of accelerated capital allowance for small value assets.

The corporate tax Malaysia 2020 applies to the residence companies operating in Malaysia. On the First 35000 Next 15000. Income tax rates.

13 rows Rate Tax RM 0 - 5000.

Corporation Tax Europe 2021 Statista

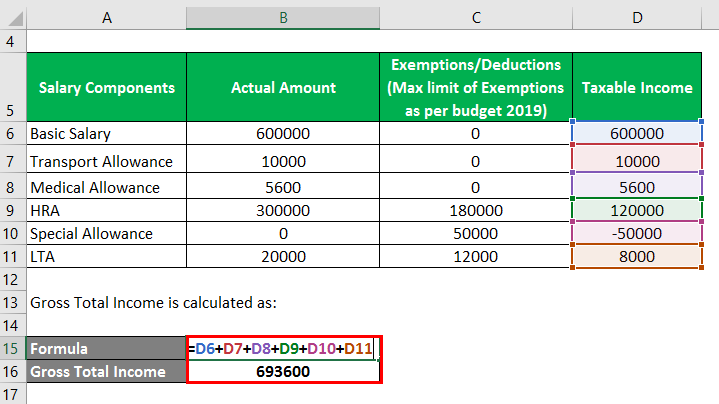

What You Need To Know About Tax Income Calculation In Malaysia Career Resources

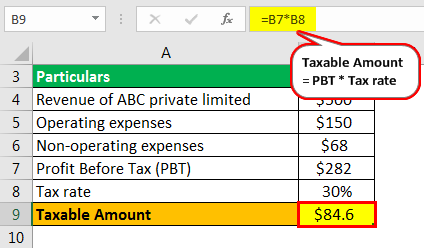

Profit After Tax Definition Formula How To Calculate Net Profit After Tax

Ecommerce Website Quotation Template Google Docs Google Sheets Excel Word Template Net Quotation Format Invoice Template Word Quotations

Taxable Income Formula Examples How To Calculate Taxable Income

Company Tax Rates 2022 Atotaxrates Info

Individual Income Tax In Malaysia For Expatriates

Get Our Sample Of Dividend Payment Voucher Template For Free Dividend Value Investing Templates

Taxable Income Formula Calculator Examples With Excel Template

Pin By Mymoneykarma On Manage You Finances Well In 2021 Financial Health Numbers Money Management

Company Tax Rates 2022 Atotaxrates Info

Image Result For Salary Slip Word Format Payroll Template Receipt Template Templates

Effective Tax Rate Formula Calculator Excel Template

Cover Story Budget 2020 Top Tax Bracket Raised To 30 Tin Number Proposed The Edge Markets

Tax Base Definition What Is A Tax Base Taxedu

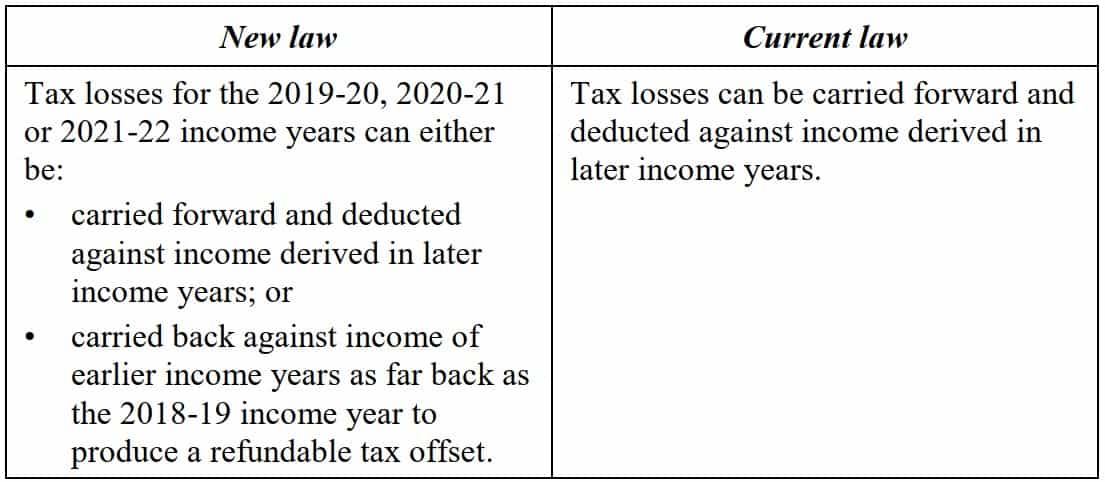

Doing Business In The United States Federal Tax Issues Pwc

Provision For Income Tax Definition Formula Calculation Examples

0 Response to "2020 Company Tax Rate Malaysia"

Post a Comment